Buying a home in Chennai has always been about timing. A few years back, buyers who took the plunge in Perambur or Pallavaram are now sitting on properties worth far more than what they paid. In fact, between 2021 and 2025, Perambur recorded a 26% price rise, while Pallavaram saw a 24% increase.

For those who missed out, it may feel like the opportunity has passed. But here’s the good news, Chennai’s real estate story is far from over. The city is entering its next growth cycle, powered by new infrastructure, expanding job hubs, and steady demand for affordable yet well-connected housing.

So, where should buyers look if they want to catch the next wave? The spotlight is now on three corridors that combine affordability with long-term potential, and each appeals to a slightly different type of buyer.

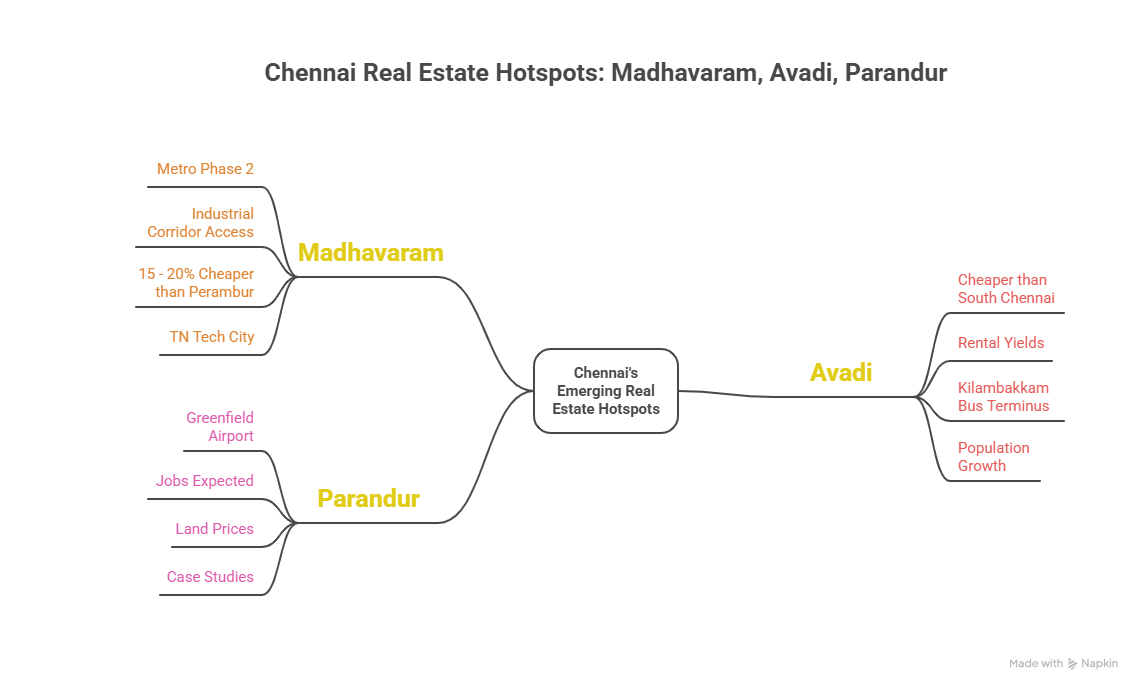

Madhavaram is rapidly moving from being a suburban fringe to a strategic residential hub.

Madhavaram is best suited for buyers who want early entry into a fast-developing hub, with appreciation potential similar to Perambur but at a lower price point.

Once known mainly as a defence township, Avadi has now grown into a hub of steady demand, strong rental yields, and improved connectivity, making properties in Avadi a compelling choice for families.

For budget-conscious families, Avadi strikes the right balance between affordability, rental demand, and appreciation potential. As detailed in From Renting to Owning: Why Avadi Is the First Step for So Many Families this shift highlights why more households are choosing Avadi as their first residential destination.

While Avadi appeals to today’s families, Parandur is a bet on tomorrow. The proposed ₹20,000 crore Greenfield Airport, along with the planned Poonamallee–Parandur Metro Extension, is set to reshape the city’s western corridor, making plots near Parandur Airport one of Chennai’s most promising long-term investments.

For investors with a long-term vision, Parandur offers transformational growth potential as the airport project advances.

Planning to invest in Parandur? Check our blog on Buying Near Parandur Airport for detailed insights.

Mind Map showing why Madhavaram, Avadi, and Parandur are emerging as Chennai’s top real estate growth hotspots in 2025.

One of the biggest shifts in 2025 is that rental hikes are no longer limited to the IT corridor, they’re spreading across almost every part of Chennai.

Take Velachery. Once a mid-market choice for young professionals, it has now moved firmly into premium territory. Even compact one-bedroom apartments here cost well over ₹22,000 today. Adyar and T Nagar now see mid-sized apartments renting above ₹50,000, shifting what was once considered “regular rent” firmly into the luxury bracket. This shift is blurring the line between standard rentals and affordable luxury in Chennai real estate, a trend that’s reshaping buyer and renter preferences alike.

On the northern side, Madhavaram has quickly become one of the fastest-moving suburbs. With the metro improving connectivity, demand for Flats in Madhavaram has surged, and rents here are already up by about 11%. It’s a reminder that infrastructure projects like the TN Tech City in Madhavaram can completely change the perception of a locality.

Even the so-called “affordable” zones are catching up. In Poonamallee and Pattabiram, 2BHK units that once rented for about ₹10,000 now cost closer to ₹20,000. For a middle-class family, that kind of jump can mean choosing between a smaller home in the city or a larger home further out. For investors, it signals strong appreciation and steady rental income.

The takeaway? Rental growth is now city-wide. Whether in central, semi-central, or suburban pockets, every area connected by jobs and infrastructure is seeing a surge. According to industry studies, this trend isn’t slowing down, it is expected to continue as connectivity improves and more families look for well-located homes. In fact, Chennai’s rental growth is now among the fastest in South India, outpacing even Hyderabad and Bangalore in some suburban zones.

To know more about how metro expansion drives real estate values, read:

Chennai Metro Projects Drive Real Estate Prices Upward.

Nearly 70% of renters now prefer gated projects over standalone houses because they offer safety, elevators, reliable utilities, and community living. If you’re exploring this lifestyle, here’s why gated community apartments are in demand.

With hybrid work setups, families need the extra room, for a home office, children’s study space, or visiting relatives. What was once a luxury is now a necessity.

Tenants are prioritising projects with modern amenities like gyms, play areas, and common spaces that support community living.

Bottom Line: Demand is strongest in growth corridors like Medavakkam, Porur, and Siruseri, where modern projects offer both space and connectivity at more affordable rates compared to central Chennai.

If there’s one factor driving Chennai’s rental surge, it’s connectivity. New metro lines, ring roads, and the IT corridor expansion are changing how families and professionals decide where to live.

Take Madhavaram. A few years ago, it was often dismissed as “too far north.” But with Metro Phase 2 bringing it closer to the city centre, families now see it as both affordable and well-connected. Naturally, rents are climbing as demand grows.

The same pattern is visible in the west. Porur and Poonamallee are no longer seen as just budget-friendly zones. With metro access and road links, they have become magnets for tenants who want reasonable prices but still need quick access to IT parks.

Down south, the OMR stretch continues to push beyond Siruseri into Kelambakkam and Padur. As jobs follow, so do tenants, and rents here are already gearing up for 15–20% hikes.

The bigger story is this: yesterday’s outskirts are today’s prime rental markets. Tenants are willing to move slightly further out if it means faster commutes and better value. And for investors, that shift translates into higher rental yields and long-term capital appreciation.

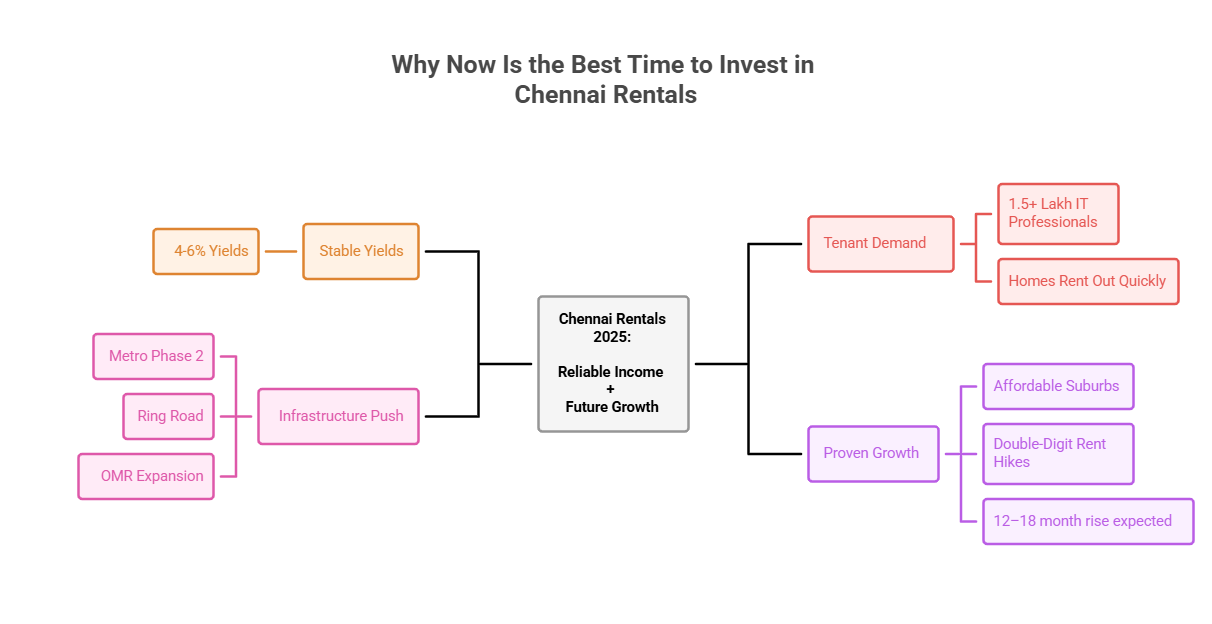

For tenants, rising rents mean tougher choices. For investors, Chennai offers a rare alignment of factors that make the market more attractive than ever:

Returns in the range of 4–6% remain consistent, higher than averages in metros like Delhi or Bangalore, positioning Chennai among the strongest rental markets in India.

With over 1.5 lakh professionals employed in IT and GCCs, housing demand is continuous, keeping vacancy levels low.

Large-scale projects such as Metro Phase 2, the Peripheral Ring Road, and the OMR corridor expansion are strengthening connectivity, steadily pushing property values upward.

Localities that were once considered affordable are showing double-digit rental increases.

A 2BHK currently rents for ₹10,000 – ₹13,000. With industrial expansion and new road links, these homes are projected to see up to a 25% increase in rents, offering investors both near-term rental growth and long-term asset appreciation.

In summary, Chennai’s rental market is not just resilient, it is expanding in both breadth and depth, offering investors the twin advantage of reliable income and capital growth.

Visual summary of the key reasons why now is the smartest time to invest in Chennai’s rental market for steady returns and future growth.

Perambur and Pallavaram have already shown that Chennai’s micro-markets can deliver double-digit appreciation in just a few years. The next chapter is now unfolding in Madhavaram, Avadi, and Parandur.

For end-users, these areas promise affordability with improving connectivity. For investors, they offer early entry into Chennai’s future growth story. Either way, 2025 is shaping up to be a decisive year for buyers who want to stay ahead of the curve.

The question is, will you wait for the headlines, or secure your place in Chennai’s next growth story today?

![]()