Over the last few years, many middle-income families put their home buying dreams on hold. Prices were high, EMIs were scary, and everything felt uncertain. But in 2025, things are finally looking different.

Across Chennai, more people earning between ₹40,000 and ₹1 lakh a month are actively buying homes again. What’s changed? A mix of lower EMIs, shorter loans, better infrastructure, and a bigger push from developers has made homeownership more possible, and smarter, than it’s been in years.

Here’s a closer look at why this year might be the right time for you to finally own your own home.

Let’s start with the biggest reason: EMIs are coming down

In 2023, many banks charged over 9% interest on home loans. In 2025, that’s dropped to around 8.35% – 8.75% (depending on your credit score and the bank). These changes follow the Reserve Bank of India’s efforts to maintain stable repo rates to support homebuyers.

That 1% difference might seem small, but over a 20-year loan, it can reduce your EMI by ₹1,000 – ₹3,000 per month. That’s a big deal for middle-income buyers.

It means you can now afford a slightly better flat, or you can breathe easier each month knowing your EMI won’t take up your whole salary.

Check this guide to improving your credit score before applying for a home loan to boost your chances of getting a better interest rate.

More buyers today are choosing shorter loan tenures.

Instead of spreading repayments over 25 or 30 years, many people are choosing 15 or 20 years. Why? Because with better salaries and dual-income households, it’s now possible to pay a little more each month and finish the loan faster.

This also saves a lot on total interest. If you pay off your home sooner, you pay less overall and become the full owner more quickly.

Real estate developers have noticed that middle-income families are ready to buy again. That’s why there are now a lot more flats in the ₹45–70 lakh range being launched in growing parts of the city.

Some of the top areas seeing this trend include:

What’s new is that these flats come with features that used to be seen only in high-end homes, like EV charging stations, security systems, power backup, and even small parks or clubhouses.

According to a 2025 JLL India report, 58% of all new homes launched in Chennai are now aimed at middle-income buyers. That’s a huge jump from just two years ago.

There’s another reason why these areas are becoming popular: the government is heavily investing in infrastructure that benefits middle-class homebuyers.

Some major upgrades:

If you’re a first-time homebuyer, there’s more good news.

You may still qualify for a subsidy under the PMAY Urban CLSS scheme, where middle-income groups (called MIG-I and MIG-II) can get interest subsidies of up to ₹2.35 lakh.

This is money directly credited to your loan account, reducing your total EMI burden.

Let’s say you buy a home but don’t want to move in right away. No problem, rental demand is rising in Chennai suburbs too.

Places like Porur, Pallavaram, Perumbakkam, Ambattur, and Velachery are now showing rental yields of 3.2% to 3.8%, which is a healthy number.

If your EMI is ₹25,000 and rent income is ₹18,000, it means your actual burden is much less. And the value of your property keeps growing at the same time.

Let’s say you buy a home but don’t want to move in right away. No problem, rental demand is rising in Chennai suburbs too.

Places like Porur, Pallavaram, Perumbakkam, Ambattur, and Velachery are now showing rental yields of 3.2% to 3.8%, which is a healthy number.

If your EMI is ₹25,000 and rent income is ₹18,000, it means your actual burden is much less. And the value of your property keeps growing at the same time.

Beyond all the numbers and trends, one thing hasn’t changed, owning a home gives you peace of mind.

Whether it’s about planning your child’s school life, staying close to family, or simply having a space that’s yours, owning a home brings emotional stability.

After the COVID years, many families realised how important that sense of ownership is. Now that jobs and finances are more stable, they’re finally acting on it.

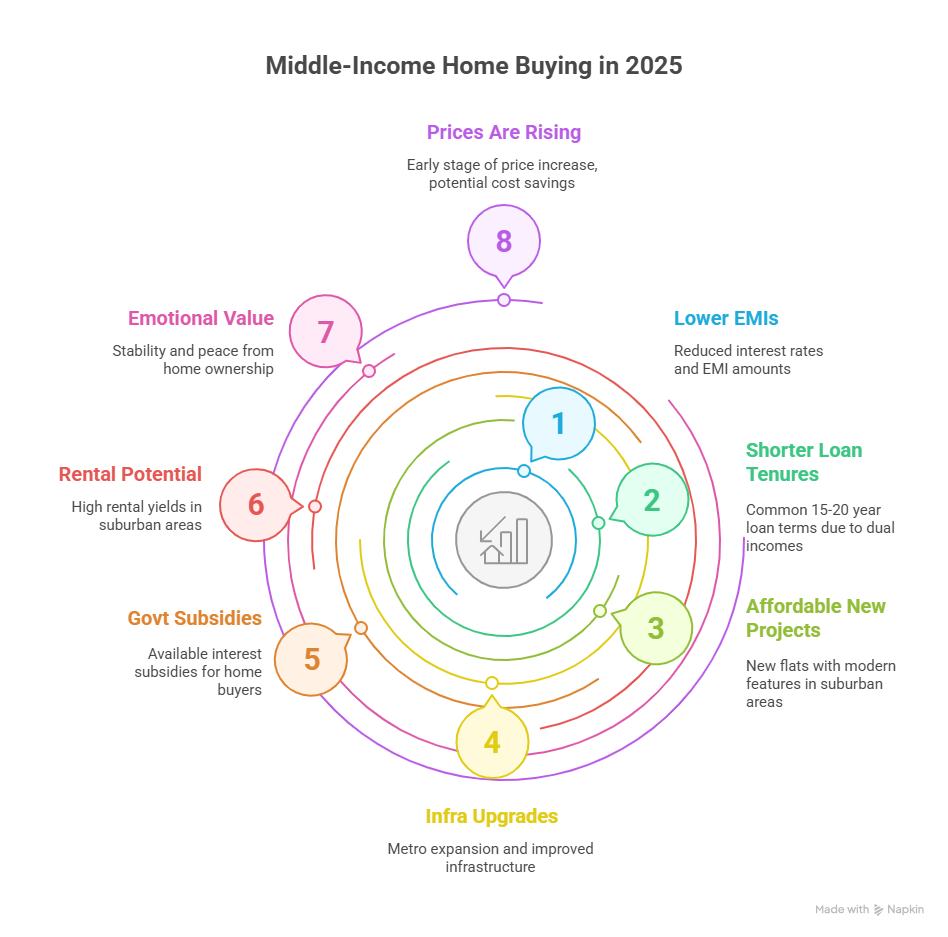

Visual summary of the top reasons why now is the smartest time for Chennai’s middle-income families to buy a home.

You might be wondering if you’re too late to the game. The answer? Not yet, but soon.

Here’s what’s happening:

If you wait another year, the same flat may cost ₹6–8 lakhs more. Buying now gives you the benefit of today’s price, plus tomorrow’s growth.

If you’re a middle-income buyer asking yourself whether now is the right time, the answer is a confident yes.

With prices still manageable, EMIs becoming lighter, and Chennai’s suburbs growing fast, this might be one of the best chances you’ll get to buy smart.

Take the time to:

This isn’t just about owning a flat, it’s about buying at the right time, before prices rise further. And in 2025, the window of opportunity is wide open.

![]()