Imagine finding your dream apartment for sale in Chennai, only to lose it because your loan wasn’t ready on time. It happens more often than you think in Chennai’s fast-moving real estate market. For most families, buying a home isn’t just a milestone, it’s often the biggest financial decision of their lives.

And while location, builder reputation, and property type are major considerations, there’s one factor that often gets overlooked until the last minute: how you plan your home loan.

In today’s competitive market, where residential flats in Chennai in places like Avadi, Madhavaram, and OMR get snapped up quickly, the choice between a pre-approved home loan and a regular loan can make or break your buying journey.

So, which one really makes sense in 2025? Let’s break it down.

A pre-approved home loan is when the lender evaluates your financials before you’ve chosen a property. Your income, expenditure, credit score, employment stability, and savings history are reviewed upfront. If eligible, you receive a sanction letter with:

This means you already know your borrowing power, giving you clarity before even shortlisting new properties in Chennai for sale.

A regular home loan is the traditional route. You identify a property first and then apply for a loan. Here, the lender conducts two levels of checks:

Only after clearing both steps does the lender disburse the loan.

Chennai’s real estate market has been heating up. According to market reports, Perambur saw a 26% rise in property values between 2021 and 2025, while corridors like OMR, Tambaram, and Avadi are experiencing steady demand.

In such conditions:

Whether you’re shortlisting affordable flats in Chennai under 60 lakhs in Avadi or eyeing premium properties for sale in Chennai on OMR, this is where pre-approved loans give you an edge.

| Factor | Pre-Approved Loan | Regular Loan |

|---|---|---|

| Timing | Done before choosing property | Done after property is finalized |

| Budget Clarity | Clear upfront - know your exact borrowing capacity | Uncertain until approval stage |

| Negotiation Power | Higher - sellers trust buyers with pre-approval | Lower - weaker bargaining position |

| Processing Speed | Faster - only property verification pending | Slower - both buyer & property checks needed |

| Flexibility | High - can explore multiple projects within your limit | Limited - tied to a single property |

| Risk of Delays | Low - you’ve already crossed financial checks | High - delays possible if issues arise in your documents |

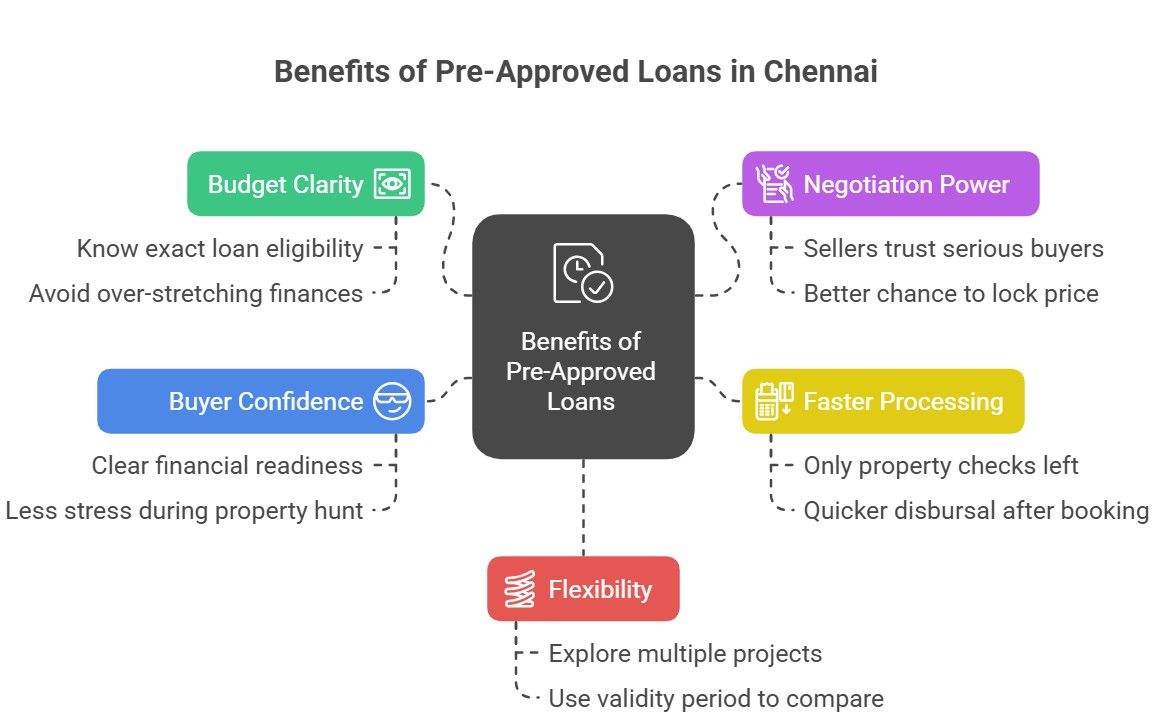

A mind map highlighting why pre-approved loans give Chennai buyers clarity, confidence, and an edge over regular loans.

Here’s why more Chennai buyers are leaning toward pre-approved loans in 2025:

Knowing your borrowing limit upfront keeps your search realistic. If your sanction letter says ₹60 lakhs, you won’t waste time chasing properties worth ₹80 lakhs. More importantly, you’ll avoid overcommitting yourself, something every buyer should remember from the hidden costs of buying a home that often go unnoticed until it’s too late.

Sellers and builders in high-demand areas like Avadi and OMR often prefer buyers with pre-approvals, as it signals seriousness and quick closure.

Once you identify the property, only property-related checks remain. This means disbursal is faster, avoiding the risk of losing out to another buyer.

For Chennai buyers exploring new launches near Parandur Airport or OMR’s upcoming sports city, this speed can make the difference between booking your preferred unit and missing out.

That said, a regular loan isn’t outdated. It’s suitable if:

One often-overlooked advantage of regular loans is that they sometimes come with slightly lower processing fees, and they can be more suitable for unique or heritage properties in Chennai where valuation assessments may require additional scrutiny.

Rejection at pre-approval stage isn’t the end, it’s actually a chance to improve before making commitments. Lenders often reject due to:

You can increase your chances by:

Many buyers reapply after corrections and get approved successfully.

Here’s the simple takeaway:

Chennai’s real estate market is evolving fast. With metro expansions, suburban growth, and price hikes across corridors, being financially ready is as important as choosing the right property.

For most buyers in 2025, a pre-approved loan isn’t just a banking formality, it’s a competitive advantage. It helps you act decisively, negotiate strongly, and avoid the stress of last-minute surprises.

Thinking of buying in Chennai this year? Start by securing your pre-approval, and you’ll be ready to lock in the right property at the right time.

![]()