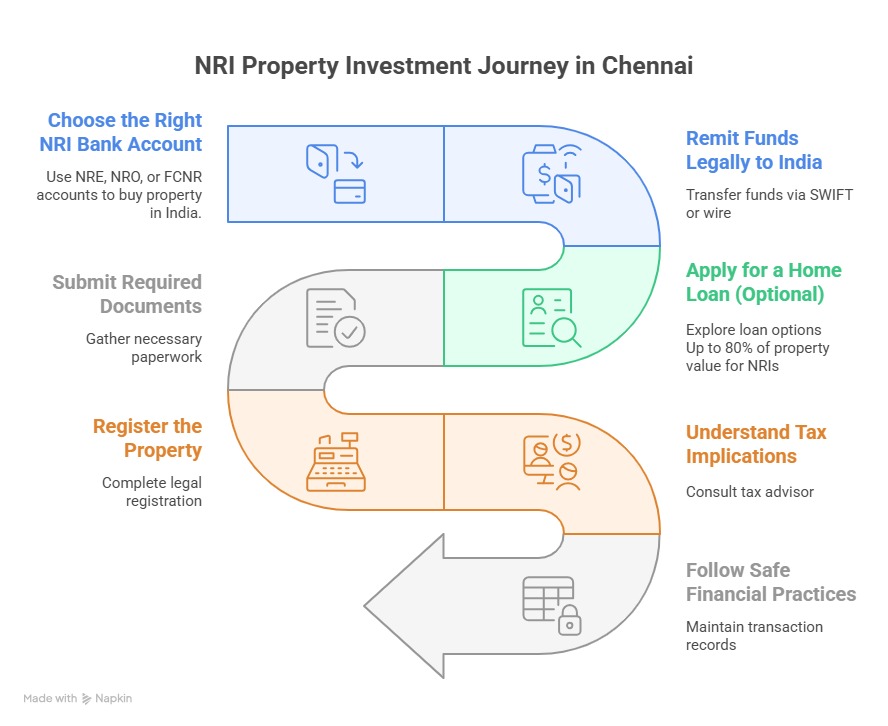

A successful property purchase in Chennai starts with understanding the financial rules for NRIs. This guide covers how to fund your investment, open and use NRI bank accounts, transfer money legally, and secure home loans from Indian banks—all while staying compliant with RBI and FEMA regulations.

NRIs must use specific Indian bank accounts for all property transactions.

NRE Account: Repatriable, ideal for income earned abroad.

NRO Account: For managing income earned in India, such as rent.

FCNR Account: Holds foreign currency deposits.

All payments for property must be routed through these accounts for legal compliance.

Learn more about NRI bank account rules.

Funds for property purchase must be remitted through normal banking channels.

Use wire transfer, SWIFT, or cheques drawn on NRE/NRO/FCNR accounts.

Keep all transaction records for future reference and repatriation.

For official RBI guidelines, visit RBI’s NRI property rules.

Indian banks and housing finance companies offer home loans to NRIs:

Eligibility: Valid passport, visa/OCI, stable overseas income, and good credit.

Loan Amount: Up to 80% of property value, subject to bank policy.

Repayment: Only through NRE/NRO accounts; EMIs must be paid in INR.

Tenure: Usually up to 20 years.

For tips, read How to improve credit score before applying for a home loan?.

Passport and visa/OCI card

Proof of overseas and Indian address

Income proof (salary slips, bank statements, tax returns)

Property documents (agreement, title deed, approvals)

Interest paid on NRI home loans is eligible for tax deduction under Indian law.

TDS is deducted on payments to builders and on rental income.

Consult a tax advisor for optimal planning.

See our NRI taxation guide for details.

A clear visual guide for NRIs on funding property in Chennai through proper bank accounts, legal transfers, and NRI home loans.

If you cannot be present in India, you can execute a POA for loan processing, document signing, and registration.

Learn more in our legal & regulatory guide for NRIs.

Always transact through official banking channels.

Avoid cash payments to ensure full legal protection.

Maintain records of all payments and loan documents.

NRI Property Buying Guide: Chennai Investment Trends, New Rules & Smart Tips

Home Buying Myths Busted: What Every Buyer Needs to Know

Avoid Defaulting on your Home Loan – A Simple Guide to Planning Your EMIs

For expert support on NRI funding, banking, and home loans, contact DRA Homes. Our team will help you navigate every financial step of your Chennai property purchase.

![]()