For NRIs, Chennai’s real estate market offers strong growth and secure investment opportunities—but only with careful due diligence. This checklist ensures you cover every legal, financial, and practical step before finalizing your property purchase in Chennai. Use it as your roadmap for a hassle-free buying experience.

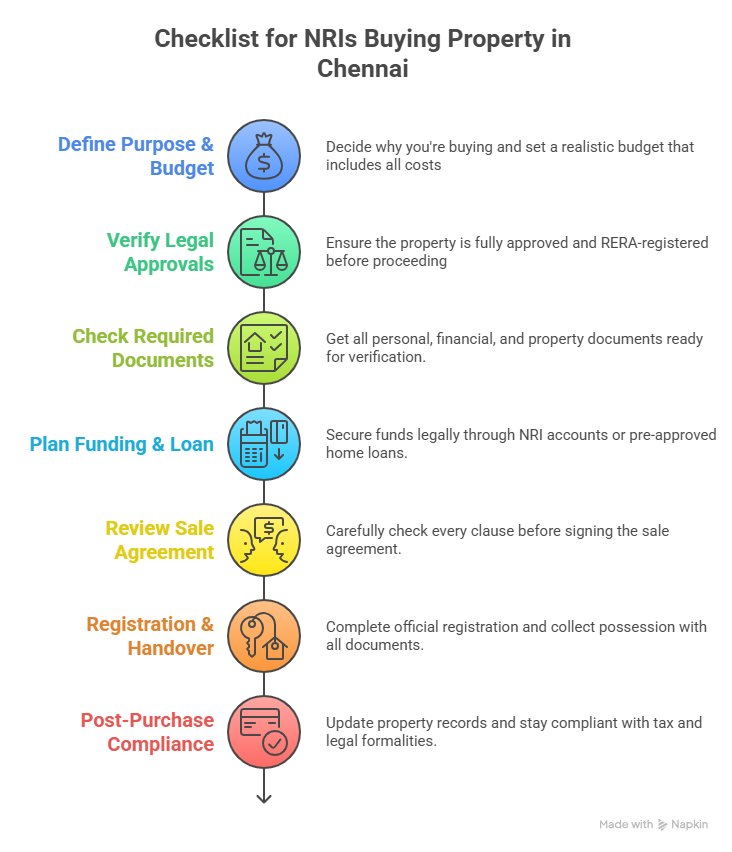

A clear step-by-step checklist to guide NRIs through every stage of buying property in Chennai.

Decide if you are buying for self-use, rental income, or long-term investment.

Fix your budget, factoring in property cost, stamp duty, registration, and other charges.

Shortlist preferred localities and property types - flats in Chennai, villas, or plots.

For guidance, see NRI Property Selection & Investment Strategy.

Confirm the project is registered with TNRERA.

Check builder’s reputation and track record.

Ensure all approvals from CMDA/DTCP/local authorities are in place.

Obtain and review the property’s title deed and encumbrance certificate.

Read more in NRI Legal & Regulatory Guide.

Passport, visa/OCI card, and PAN card

Proof of overseas and Indian address

NRE/NRO account details

Power of Attorney (if you cannot be present)

Sale agreement, title deed, and all property approvals

For a full list, see Step-by-Step Guide for NRIs to Buy Property in Chennai.

Ensure funds are in your NRE/NRO/FCNR account.

If required, get pre-approval for an NRI home loan from an Indian bank.

Make all payments through legal banking channels—never in cash.

Learn more in NRI Financial Guide: Funding, Banking & Home Loans.

Carefully check all terms, payment schedules, and possession dates.

Ensure clauses on penalties, cancellation, and refund are clear.

Confirm the agreement is executed on stamp paper and registered.

For expert tips, read 5 Important Points before signing sale & construction agreements.

Carefully check all terms, payment schedules, and possession dates.

Ensure clauses on penalties, cancellation, and refund are clear.

Confirm the agreement is executed on stamp paper and registered.

For expert tips, read 5 Important Points before signing sale & construction agreements.

Register the property at the Sub-Registrar’s office in Chennai.

Pay stamp duty and registration charges as per Tamil Nadu rules.

Collect original documents, possession letter, and utility connections.

Update property records with the local municipal authority.

If renting out, declare rental income and pay applicable taxes.

Keep all transaction records for future reference and repatriation.

See NRI Taxation Guide and Repatriation & Inheritance Guide.

Skipping RERA or legal checks

Incomplete documentation

Ignoring tax compliance

Not using official banking channels

For more, read Home Buying Myths Busted: What Every Buyer Needs to Know.

Request your printable NRI property buying checklist by contacting DRA Homes.

NRI Property Buying Guide: Chennai Investment Trends, New Rules & Smart Tips

Advantages of buying homes in gated community developments

For step-by-step guidance and the latest project options, contact DRA Homes. Our team is dedicated to helping NRIs make safe, successful property investments in Chennai.

All anchor text is varied and natural for SEO and user experience.

If you need this checklist as a downloadable PDF or want more Chennai-specific tips, let me know.

![]()