For NRIs, Chennai stands out as one of India’s most dynamic and secure real estate markets. Whether you are looking for a homecoming, a future investment, or a source of rental income, this guide offers everything you need to know about investing in Chennai property as an NRI. DRA Homes, a leading Chennai developer, brings you this comprehensive resource to help you make informed, confident decisions.

Chennai’s real estate market is driven by strong economic growth, robust infrastructure, and a cosmopolitan culture. For NRIs, the city offers:

High rental yields and capital appreciation

Secure legal environment with RERA compliance

Modern residential projects in prime locations

Excellent connectivity and social infrastructure

Learn more about why NRIs invest in Indian real estate.

For available options, see our properties in Chennai for sale.

NRIs can invest in a wide range of properties including:

Apartments and flats in gated communities

Villas and independent houses

Plots and land (with certain restrictions)

Ready-to-move and under-construction homes

Explore the types of properties NRIs can buy in India.

Browse flats in Chennai for sale and flats in OMR for sale.

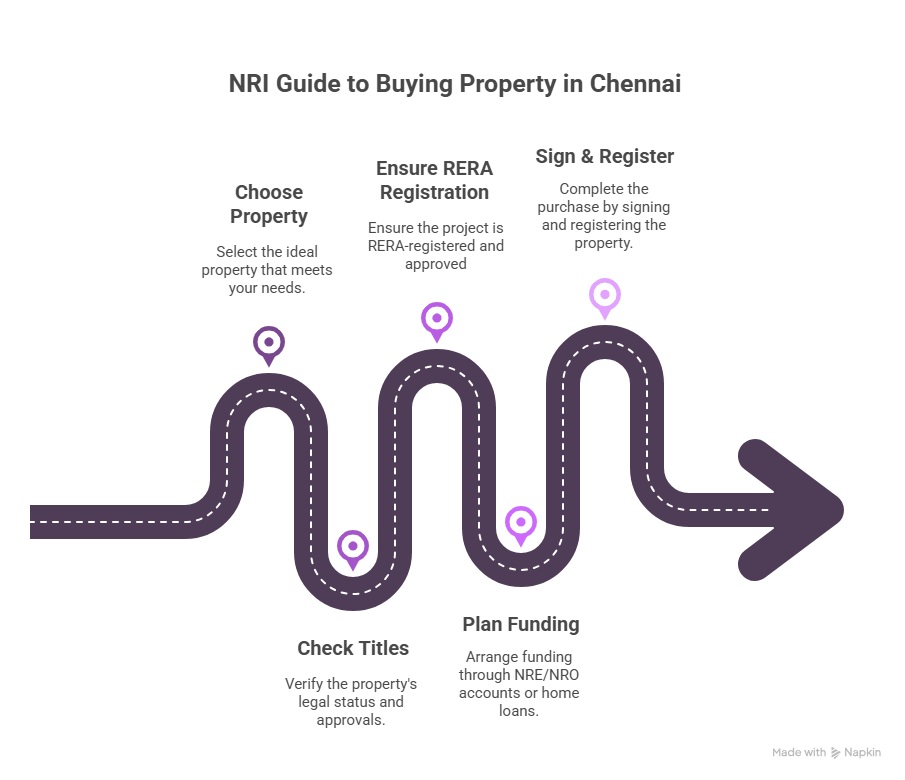

Buying property in India as an NRI involves clear steps:

1. Shortlist properties and verify legal titles

2. Ensure RERA registration and builder credibility

3. Arrange funding through NRE/NRO accounts or home loans

4. Execute sale agreement and register the property

See the step-by-step guide for NRIs to buy property in India for detailed instructions.

A quick visual guide outlining the 5 key steps NRIs must follow to buy property in Chennai with confidence.

Chennai real estate is governed by strict legal frameworks to protect buyers:

Only RERA-registered projects are recommended (TNRERA official site)

FEMA and RBI guidelines regulate NRI property transactions

Power of Attorney (POA) can be used for remote transactions

Read the legal & regulatory guide for NRIs.

NRIs can fund property purchases through:

NRE, NRO, or FCNR accounts

Home loans from approved Indian banks

Understand the NRI financial guide: funding, banking & home loans.

Tax implications for NRIs include:

Tax on rental income earned in India

Capital gains tax on property sale

TDS applicable on property transactions

Refer to the NRI taxation guide.

For official tax rules, visit Income Tax India.

Tax implications for NRIs include:

NRIs can repatriate proceeds from property sale subject to RBI limits and documentation. Inheritance laws allow NRIs to inherit and sell property in India.

Get details in the repatriation & inheritance guide for NRIs.

See RBI guidelines for more.

Chennai offers diverse choices:

Compare land, apartments, and villas

Ready-to-move vs under-construction homes

Top localities for NRI investment

Explore property selection & investment strategy.

Browse flats in OMR for sale for popular options.

Use our practical checklist to:

Verify builder and property documents

Ensure RERA and legal compliance

Plan finances and tax documentation

Access the NRI property buying checklist for Chennai.

Find answers to common questions about NRI property investment, remote buying, and document verification.

Stay updated with Chennai’s property trends and expert tips:

NRI Property Buying Guide: Chennai Investment Trends, New Rules & Smart Tips

Chennai’s Real Estate Boom: 4BHK Prices Surge by 44% in 2024

Top 6 Chennai Localities NRIs Should Consider for Real Estate Investment

Browse all properties in Chennai for sale and flats in Chennai for sale to start your journey.

Ready to invest or need personalized guidance?

Connect with DRA Homes, Chennai’s top property developer, for expert support on every step of your NRI real estate journey.

![]()